Be in charge of the way you increase your retirement portfolio by utilizing your specialised knowledge and interests to invest in assets that match using your values. Obtained abilities in real estate property or personal equity? Utilize it to aid your retirement planning.

As an investor, nevertheless, your choices aren't restricted to stocks and bonds if you select to self-direct your retirement accounts. That’s why an SDIRA can transform your portfolio.

An SDIRA custodian differs since they have the suitable team, expertise, and potential to maintain custody on the alternative investments. The initial step in opening a self-directed IRA is to find a supplier that is definitely specialised in administering accounts for alternative investments.

Whether or not you’re a monetary advisor, investment issuer, or other monetary Skilled, investigate how SDIRAs can become a robust asset to improve your organization and realize your professional goals.

Homework: It is really termed "self-directed" for the cause. Using an SDIRA, you will be entirely answerable for completely exploring and vetting investments.

Complexity and Responsibility: Having an SDIRA, you've more control above your investments, but In addition, you bear much more duty.

A self-directed IRA is definitely an unbelievably potent investment motor vehicle, but it really’s not for everyone. Because the declaring goes: with good power comes fantastic duty; and with the SDIRA, that couldn’t be far more real. Keep reading to discover why an SDIRA may well, or won't, be in your case.

Buyer Help: Try to look for a supplier that offers devoted assistance, including access to proficient specialists who can solution questions on compliance and IRS rules.

Set just, for those who’re searching for a tax effective way to construct a portfolio that’s additional personalized in your interests and skills, an SDIRA could possibly be the answer.

Prior to opening an SDIRA, it’s crucial to weigh the prospective benefits and drawbacks according to your unique financial objectives and danger tolerance.

However there are lots of Rewards connected to an SDIRA, it’s not devoid of its have drawbacks. Many of the prevalent explanation why traders don’t select SDIRAs include things like:

Introducing dollars on to your account. Do not forget that contributions are subject to once-a-year IRA contribution limitations established with the IRS.

Larger Expenses: SDIRAs normally come with increased administrative fees in comparison to other IRAs, as specific facets of the administrative approach can't be automated.

This features understanding IRS regulations, managing investments, and averting prohibited transactions that could disqualify your IRA. A scarcity of information could result in high-priced issues.

Subsequently, they have a tendency not to advertise self-directed IRAs, which supply the pliability to invest inside of a broader choice of assets.

Ease of Use and Technology: A person-helpful platform with online applications to track your investments, post paperwork, and control your account is essential.

Criminals in some cases prey on SDIRA holders; encouraging them to open up accounts for the objective of generating fraudulent investments. They frequently fool investors by telling them that When the investment is accepted by a self-directed IRA custodian, it must be legitimate, which isn’t true. All over again, You should definitely do extensive due diligence on all investments you end up picking.

SDIRAs will often be utilized by hands-on traders who are prepared to take Precious metals investment firms on the threats and duties of choosing and vetting their investments. Self directed IRA accounts can be perfect for investors which have specialized awareness in a niche market place they want to put money into.

For those who’re searching for a ‘set and fail to remember’ investing system, an SDIRA probably isn’t the correct decision. Simply because you are in overall Regulate about each individual investment built, It is really your choice to perform your very own research. Bear in mind, SDIRA custodians usually are not fiduciaries and cannot make recommendations about investments.

Jennifer Grey Then & Now!

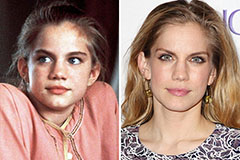

Jennifer Grey Then & Now! Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Robert Downey Jr. Then & Now!

Robert Downey Jr. Then & Now! Yasmine Bleeth Then & Now!

Yasmine Bleeth Then & Now! Morgan Fairchild Then & Now!

Morgan Fairchild Then & Now!